WE ARE LEADERS IN COMMERCIAL TRUCK INSURANCE SOLUTIONS

Bobtail Insurance

in partnership with

Our guide below also covers the differences between bobtail insurance and non-trucking liability, how much it costs, what it covers, and more.

Table of Contents

To help you find the right bobtail insurance policy, we reviewed more than 25 of the most popular insurance carriers for owner operators based on coverage options, customer experience, pricing, and financial strength.

Our guide below also cover the differences between bobtail insurance and non-trucking liability, how much it costs, what it covers, and more.

For those just looking for a few recommendations, here are our top choices.

OOIDA Truck Insurance

- Option for New Ventures & Drivers

- Will insure new ventures & drivers

By clicking “Get Quote” or calling you will go to one of our insurance partners. The providers above may not be one of the providers in their network at this time.

Comparing Options – Methodology

To curate our list of the best bobtail insurance companies, we started with more than 25 companies and then narrowed down our list based on the following factors listed below.

Summary – Our Advice

While this list is a great starting point, it’s important to get quotes from multiple companies as there is no single “best” insurance company. The best option can vary depending on your unique situation.

Buyers should speak with an agent or broker about their specific insurance needs because many insurers and trucking companies use terms like bobtail and non-trucking liability interchangeably.

Working with an insurance agent can also help you save time and money because they should provide quotes from multiple insurers. They may also have access to insurers that only sell through agents and not directly to trucking companies. That said, multiple insurers listed below do sell directly so you can easily get online quotes yourself.

Best Bobtail Truck Insurance Companies

National Independent Truckers Insurance Company (NITIC)

Best Overall

Pros

- Short-term & temporary truck insurance available

- Flexible coverage options

Cons

- Newer company

Overview

NITIC uses the terms bobtail insurance and non-trucking liability interchangeably, so buyers should discuss their specific coverage needs with an agent and their motor carrier before obtaining a policy.

Customers can purchase insurance directly from NITIC.

Coverage

- 48 states (unavailable in Alaska and Hawaii)

- Flexible coverage options

Customer Experience

- Low complaint ratio with NAIC

Pricing

- Online quotes

- Low down payments

Financial Strength

- B++ from A.M. Best

OOIDA Bobtail Insurance

Great for New Ventures & Drivers

Pros

- Covers new ventures & drivers

- Competitive pricing

Cons

- Not rated by AM Best

- Technology is behind industry leaders

Overview

Run by the Owner-Operator Independent Drivers Association, OOIDA is an international trade association for professional truckers. Owner operators can purchase insurance directly from OOIDA without working with an insurance agency.

OOIDA distinguishes between bobtail liability, non-trucking liability, and unladen insurance so truckers can get the exact coverage they need. The company also offers temporary bobtail insurance.

Coverage

- All 50 states

- Will insure new ventures & drivers

- Wide range of additional coverage options

Customer Experience

- Low complaint ratio with NAIC

- Certificates of insurance are faxed or mailed within 24 hours

- Additional OOIDA benefits include fuel cards, discounted load boards, etc

Pricing

- Reputation for competitive pricing

- Online payments

- Liability insurance is offered through a Risk Retention Group (RRG)

Financial Strength

- Because OOIDA liability insurance is through an RRG, it is not rated by A.M. Best. However, for owner operators leased to a motor carrier, this shouldn’t be an issue when dealing with shippers and brokers because they will be reviewing at the motor carrier's policy.

Progressive

Best for Non-Trucking Liability

Pros

- Covers new ventures & drivers

- Discount programs

Cons

- Offers non-trucking liability but not bobtail

Overview

While Progressive does not offer bobtail liability policies, they do offer non-trucking liability, unladen, and physical damage coverage, which will satisfy the requirements of many motor carriers.

Progressive has a great online tool for obtaining quotes and their insurance can be purchased online or through an agent.

Coverage

- All 50 states

- Will insure new ventures & drivers

- Wide range of additional coverage options

Customer Experience

- Low complaint ratio with NAIC

- Ranked #1 in digital experience by Keynova Group

- Ranked #3 in 2022 JD Power survey on customer satisfaction

Pricing

- Online quotes

- Discounts for drivers with 2+ years of experience

- Discounts for businesses with 3+ years of experience

- Up to 15% discount when premiums are paid annually

- Additional discounts available when bundling insurance or sharing ELD data

Financial Strength

- A+ from A.M. Best

Owner Operator Direct (Lancer Insurance)

Pros

- Flexible payment terms

- Low complaint ratio with NAIC

Cons

- Won’t cover new drivers or those under 25

Overview

As its name suggests, Owner Operator Direct specializes in trucking insurance for owner operators, whether they operate under their own authority or someone else’s authority.

Owner Operator Direct uses the terms bobtail insurance and non-trucking liability interchangeably, so prospective buyers should discuss specific coverage needs with an agent from Owner Operator Direct and their motor carrier. Its business is underwritten by Lancer Insurance Company.

Coverage

- All 50 states

- Wide range of additional coverage options

Customer Experience

- Low complaint ratio with NAIC

- Certificates of insurance can be accessed online 24/7

Pricing

- Easy online quoting

- Flexible payment terms

- Policies offer combined deductibles

Financial Strength

- A- from A.M. Best

Northland Insurance

Pros

- Flexible coverage options

- Small company backed by major insurance carrier

Cons

- Average complaint ratio with NAIC

Overview

Northland has specialized in trucking for decades, and insures local drivers and long-haul truckers alike.

Northland uses the terms bobtail insurance and non-trucking liability interchangeably, so prospective buyers should discuss specific coverage needs with an agent and their motor carrier. Insurance through Northland will need to be acquired through an independent insurance agent.

Coverage

- All 50 states

- Flexible coverage options

Customer Experience

- Average complaint ratio with NAIC

- Parent company (Travelers) is the second largest commercial auto insurer by premiums written

Pricing

- Flexible interest-free payment terms

Financial Strength

- A++ from A.M. Best

1st Guard Insurance

Pros

- Covers new ventures & drivers

- Discount programs

Cons

- Offers non-trucking liability but not bobtail

Overview

1st Guard sells directly to truckers, and specializes in commercial truck insurance and fleet insurance.

While it does not offer bobtail liability policies, 1st Guard does offer non-trucking liability and physical damage coverage, which will satisfy the requirements of many motor carriers.

Coverage

- All 50 states

- Will insure new ventures & drivers

- Wide range of additional coverage options

Customer Experience

- Low complaint ratio with NAIC

- Ranked #1 in digital experience by Keynova Group

- Ranked #3 in 2022 JD Power survey on customer satisfaction

Pricing

- Online quotes

- Discounts for drivers with 2+ years of experience

- Discounts for businesses with 3+ years of experience

- Up to 15% discount when premiums are paid annually

- Additional discounts available when bundling insurance or sharing ELD data

Financial Strength

- A+ from A.M. Best

What is bobtail insurance?

Bobtail insurance provides liability coverage when an owner operator drives their tractor without a trailer. Unlike non-trucking liability insurance, bobtail insurance can cover both business and personal trips.

Motor carriers often require owner operators to carry bobtail liability or non-trucking liability insurance to avoid claims against the motor carrier’s primary liability insurance while owner operators are not hauling for the company.

Bobtail insurance is often confused with non-trucking liability (NTL) insurance and some insurers and motor carriers even use the terms interchangeably despite a few key differences.

Because of this, it’s important to confirm that the requirements set in your lease agreement match the coverage offered by your insurance company.

Bobtail vs Non-trucking Liability vs Deadhead vs Unladen Insurance

| Bobtail | Non-trucking Liability | Deadhead | Unladen |

|---|---|---|---|

| Covers owner operators whenever they drive without a trailer, whether they are driving for business or personal reasons. | Covers owner operators anytime they are driving for personal reasons, whether or not they are driving with a trailer. | Covers owner operators whenever they drive with an empty trailer. | Covers owner operators anytime they are not loaded with cargo, whether they are deadheading or bobtailing. |

Bobtail & Physical Damage Insurance

Bobtail insurance is almost always paired with a physical damage policy.

While bobtail insurance provides liability coverage when not hauling a trailer, physical damage insurance protects tractors whether they are hauling a trailer or not.

For example, if an owner operator gets into an accident while hauling a load, the motor carrier’s primary liability insurance will cover third-party injuries and property damage. However, an owner operator would still need physical damage insurance to repair or replace their own vehicle.

Sometimes the term “bobtail insurance” can refer to bobtail liability or NTL plus physical damage.

Who needs bobtail insurance?

- Owner operators that are leased onto a motor carrier and occasionally drive without a trailer may be required in their lease agreement to carry bobtail insurance.

Some motor carriers, however, will only require non-trucking liability insurance but may still refer to this coverage as “bobtail insurance.” In this case, the motor carrier would cover bobtailing for business purposes under their primary liability insurance policy.

While neither bobtail nor non-trucking liability insurance is generally required by law, motor carriers typically require owner operators to carry bobtail or NTL to minimize claims against their primary liability insurance.

Owner operators that own their own trailer will likely need non-trucking liability, deadhead, or unladen insurance and not bobtail liability.

- Owner operators should read their lease agreement and discuss specifics with their motor carrier before purchasing a policy.

Motor carriers and owner operators driving under their own authority also do not need bobtail liability or NTL because their primary liability insurance covers their vehicles whenever they are in use.

While it may seem obvious, box trucks, cement mixers, tow trucks, and many other commercial vehicles also don’t need bobtail insurance because they cannot be driven without a trailer. Bobtail insurance is specifically tailored to lease operators driving under a motor carrier.

Temporary Bobtail insurance

It’s not uncommon for owner operators to need temporary or short-term bobtail insurance after they purchase a new truck but before they sign onto a carrier. Owner operators in between carriers may also need temporary insurance as some bobtail and NTL policies require a lease agreement to be in effect.

Depending on the insurance provider, policies can be purchased over 1-5 day periods or up to 30 days.

Like regular bobtail insurance, most temporary policies are paired with physical damage insurance.

What does bobtail liability insurance cover?

Bobtail liability insurance covers owner operators when they drive a semi-truck without a trailer for business or personal reasons.

In the event of an incident, bobtail liability insurance will cover third-party injuries, property damage, and legal fees and other expenses.

Common scenarios where bobtail coverage kicks in include the period between dropping off one trailer and picking up another, the drive home from a delivery where the trailer was dropped off, and driving without a trailer for personal reasons.

What does bobtail liability insurance not cover?

As the name suggests, bobtail liability insurance never covers trucks while a trailer is attached.

Because it is liability insurance, it won’t cover physical damage to the insured’s truck or medical expenses incurred by the driver or passengers.

Some bobtail policies are also only available to permanently leased operators so new owner operators or those between contracts may need to look for temporary insurance.

How much does bobtail insurance cost?

While bobtail liability typically only costs $20-60 per month, most owner operators will also need other coverage like physical damage and general liability. In total, most owner operators can expect to pay $3,000-$5,000 a year in premiums.

Comparing Options

Bobtail vs Non-Trucking Liability Insurance

Bobtail insurance covers owner operators whenever they drive without a trailer, whether they are driving for business or personal reasons.

Non-trucking liability (NTL), on the other hand, protects owner operators anytime they are driving for personal reasons, whether or not they have a trailer in tow.

The two types of coverage are easy to confuse, and they are sometimes used interchangeably by insurers and trucking companies. Owner operator should discuss the specifics with their motor carrier and potential insurers before making a purchase.

Non-Trucking Liability Example

A driver under lease needs to obtain coverage for the times they drive when not on the job, for example if they use the truck for shopping or other errands on their day off. Non-trucking liability insurance covers instances like these, whether driving with or without a trailer.

Bobtail Liability Example

Owner operators might drive their tractor without a trailer while on the job or in their personal time. For example, a driver might head from a drop-off location to a new pick-up without a trailer, which bobtail liability insurance would cover.

Choosing a Policy

The two terms are often used interchangeably because there are many instances when either bobtail insurance or non-trucking liability would cover the operator. For example, driving without a trailer for personal reasons could be covered under either insurance type. Leased owner operators are typically required to get one type of coverage or the other but not both. The motor carrier will be the entity that makes that determination.

Driving without a trailer is more common for the average owner operator than driving a semi for personal reasons so bobtail insurance is often more expensive than non-trucking liability.

Bobtail vs Deadhead Insurance

What is deadheading?

Deadheading is driving a truck with an empty trailer attached.

How does bobtailing compare to deadheading?

Deadheading is sometimes confused with bobtailing because both situations involve driving without cargo. However, deadheading is driving with an empty trailer that is still attached to the tractor while bobtailing has no trailer attached.

Because the trailer is still attached while deadheading, weight distribution throughout the truck is not compromised to the same extent as it is when a truck is bobtailing, which means deadheading is comparatively less dangerous. The reduced risk means deadhead insurance policies are often less expensive than bobtail insurance coverage.

Bobtail vs Unladen Liability Insurance

What is unladen liability insurance?

Unladen liability insurance provides coverage while a truck is driven with an empty trailer or without one.

How does unladen liability compare to bobtail insurance?

Unladen liability insurance covers semi-trucks any time they are not loaded with cargo, whether they are deadheading with an empty trailer or bobtailing without a trailer at all.

Unladen liability insurance, which some motor carriers require for their owner operators, makes no distinction between a truck is being used for business or non-business purposes. Coverage kicks any time the truck is without cargo.

Unladen liability insurance is a newer type of insurance and because it is more comprehensive some policies can cost more than bobtail or deadhead insurance. Leased operators should thoroughly explore their options with a motor carrier before obtaining an unladen liability policy.

FAQs

Is bobtail insurance required?

While bobtail insurance is not required by law, motor carriers typically require their owner operators to either carry bobtail insurance or non-trucking liability insurance.

Is non-trucking liability the same as bobtail insurance?

No, while non-trucking liability and bobtail insurance are often confused, the two policies cover different scenarios.

Non-trucking liability covers owner operators when they are not under dispatch whether or not they are hauling a trailer.

Bobtail, on the other hand, covers owner operators when they are not hauling a trailer, whether or not they are under dispatch.

Does bobtail insurance cover physical damage?

No, bobtail insurance does not cover damage done to the insured’s vehicle. However, most bobtail policies are paired with physical damage coverage.

Does Geico offer bobtail insurance?

No, Geico does not offer bobtail insurance as they don’t offer any commercial auto insurance for semi-trucks.

What is a bobtail truck?

When a semi-truck is driven without a trailer attached, it is commonly referred to as “bobtailing.”

What does deadhead mean in trucking?

Deadheading is when a truck driver is not hauling a load but the trailer is still attached.

Why are bobtail tractors harder to stop?

Bobtail tractors are harder to stop because most of a semi-truck’s braking power is in the rear axles and without the weight of the trailer bearing down on those axles, the braking power is greatly diminished.

Additionally, because most of the weight is over the front axle while bobtailing, steering also becomes more difficult.

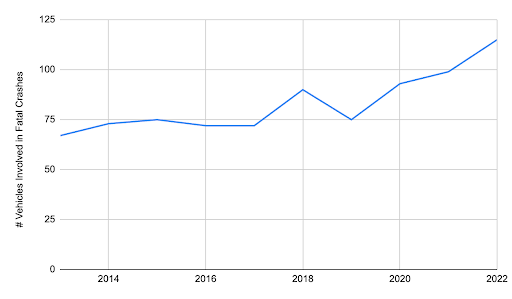

In fact, multiple studies including reports by the Society of Automobile Engineers, the Federal Motor Carrier Safety Administration, and the Michigan Department of Transportation show that bobtail trucks are overrepresented in big rig accidents, including those that cause fatalities or major property damage.

Bobtail Accident Statistics

How dangerous is bobtailing?

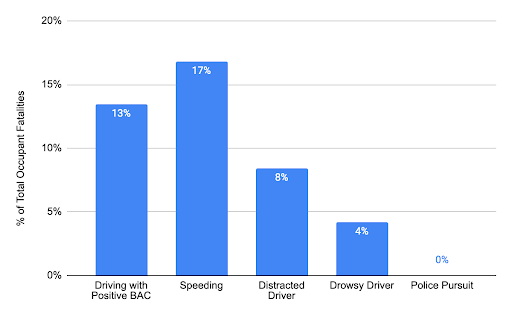

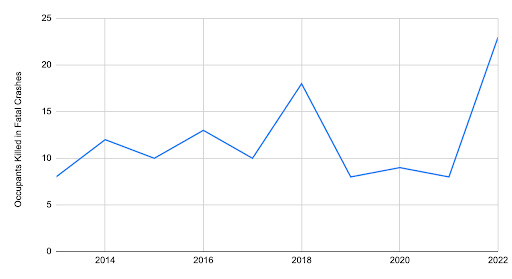

In 2022, 115 bobtail trucks were involved in fatal accidents. However, there were only 23 fatalities for the bobtail driver (or other occupants of the bobtail).

When do most fatal bobtail accidents occur?

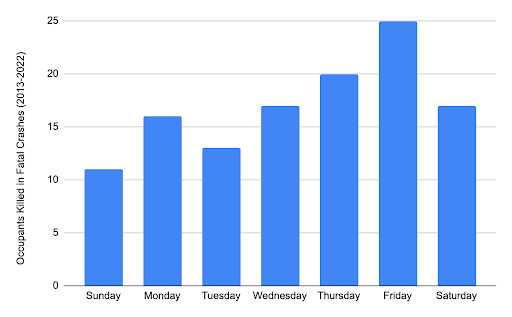

Most fatal bobtail accidents occur on Fridays.

Why do bobtail accidents happen?

Most fatal bobtail accidents occur because of speeding by either the bobtail driver or the other driver.